Your Guide To Medicare Supplements

Medicare Supplement Plans, also known as Medigap, have become a critical aspect of healthcare for millions of Americans. But what exactly are these plans? How did they start? When can you sign up, and what are the requirements? This article “Your Guide to Medicare Supplements” aims to answer these questions and more.

It is my intention to answer most of your questions in this article, but if I miss something please email me at daniel@pascohernandoseniorservices.org and I will answer your question.

The Origin of Medicare Supplement Plans

Medicare was signed into law in 1965, offering Americans aged 65 or older a federal program for health coverage. However, it quickly became apparent that Medicare didn’t cover all healthcare costs. There were still many out-of-pocket expenses, such as copayments, coinsurance, and deductibles.

Recognizing this gap, the government introduced Medicare Supplement Plans in the 1980s. These were designed to cover the areas where traditional Medicare fell short. Private insurance companies offer these plans, and they are regulated by both state and federal laws to protect consumers.

What Medicare Supplement Plans Do

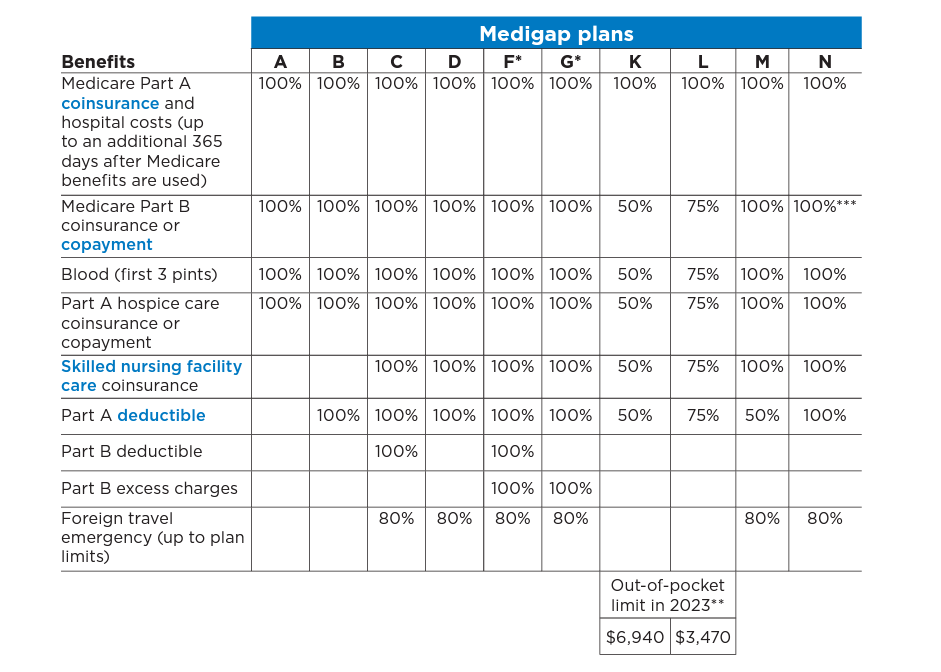

Medicare Supplement Plans are designed to fill in the gaps left by Medicare Parts A and B, otherwise known as Original Medicare. Depending on the specific plan, Medigap may cover:

Part A Deductibles and Copayments

This can include hospital stays and hospice care.

Part B Deductibles and Copayments

Such as visits to doctors, outpatient services, and preventive care.

Excess Charges:

If a healthcare provider charges more than the Medicare-approved amount.

Foreign Travel Emergency Care

Requirements for Medicare Supplement Plans

Here are the main requirements to be eligible for a Medigap policy:

- You Must Have Medicare Parts A and B: Medigap is a supplement to Original Medicare, so you need to have both parts to qualify.

- You Must Live in the Area Where the Policy is Offered: Medigap policies are specific to certain geographical areas. If you move, you might need a new policy.

- You Cannot Have a Medicare Advantage Plan: If you have a Medicare Advantage Plan, you’ll need to leave it before your Medigap policy begins.

- You Must Pay a Monthly Premium: This is in addition to the premium you pay for Medicare Part B. Costs vary depending on the plan, the company, your age, and your location.

When You Can Sign Up

The best time to sign up for a Medicare Supplement Plan is during the Medigap Open Enrollment Period. This six-month period starts on the first day of the month when you are both 65 or older and enrolled in Medicare Part B.

During this time, you have the right to buy any Medigap policy sold in your state, regardless of your health status. The insurance company can’t charge you more or deny coverage based on any pre-existing conditions.

Conclusion

Medicare Supplement Plans provide a vital service for many Americans, filling in the gaps left by Original Medicare. From their inception in the 1980s to the multiple plan options available today, Medigap policies offer flexibility and security for various healthcare needs.

When considering a Medigap policy, carefully review your healthcare needs and budget. Speak with a healthcare professional or insurance agent specializing in Medigap policies to find the best fit for you.

Remember, timing is critical, and taking advantage of the Medigap Open Enrollment Period can save you time, money, and stress. By understanding your options and the requirements, you can make an informed decision that best supports your health and well-being.

If you have questions about Medicare, don’t hesitate to contact one of our local agents who work in your community. Visit PascoHernandoSeniorServices.org to schedule an appointment.