5/5

Daniel Vujinovic

Senior Agent - Pasco Hernando senior Services LLC

11 years experience

Say goodbye

to Restrictions

Medigap plans offer freedom of choice in location and the treatment you want

- Go to any Doctor who accept Medicare anywhere in the uS

- Go to any Facility that accepts Medicare anywhere in the US

- No Referrals Required!

- No Pre-Authorizations

- Predictable Yearly Medical Budget

- International travel coverage

What does a Medigap Policy pay for?

A Medicare Supplement insurance policy is designed to cover the percentage that Medicare makes you pay.

If you have Original Medicare, on average Medicare will pay 80% of the bill and you are responsible for 20%. That can leave you exposed to bills in the tens of thousands if something happens.

When can you buy a Medigap Policy?

Generally, the best time to buy a Medicare Supplement insurance plan is during your Medigap Open Enrollment Period (OEP). This period lasts six months and begins the month in which you are both 65 and enrolled in Medicare Part B.

Medicare Supplement insurance doesn’t have restrictions on enrollment periods the way other Medicare coverage does. As long as you’re enrolled in Original Medicare, Part A and Part B, you can apply for a Medicare Supplement insurance plan anytime.

The reason the OEP is important is that this is when you have guaranteed-issue rights to buy a Medicare Supplement (Medigap) insurance plan. Insurance companies can’t use medical underwriting during this time. Medical underwriting considers your health conditions and the costs to cover you.

When you don’t have guaranteed-issue rights to a Medigap plan, insurance companies may reject you or charge you more based on your health.

situations that could qualify you for guaranteed-issue rights, besides your OEP?

- You dropped your Medicare Supplement insurance plan to use your trial right to try a Medicare Advantage plan. Less than a year has passed and you want to switch back to Original Medicare.

- Your Medicare Advantage plan stops providing care in your area and you return to Original Medicare.

- You move out of your Medicare Advantage plan’s service area and you return to Original Medicare.

- Your Medicare Supplement insurance plan committed fraud or misled you

- Your Medicare Supplement insurance plan went bankrupt

kNOW tHE BASIC, WE'LL DO THE REST

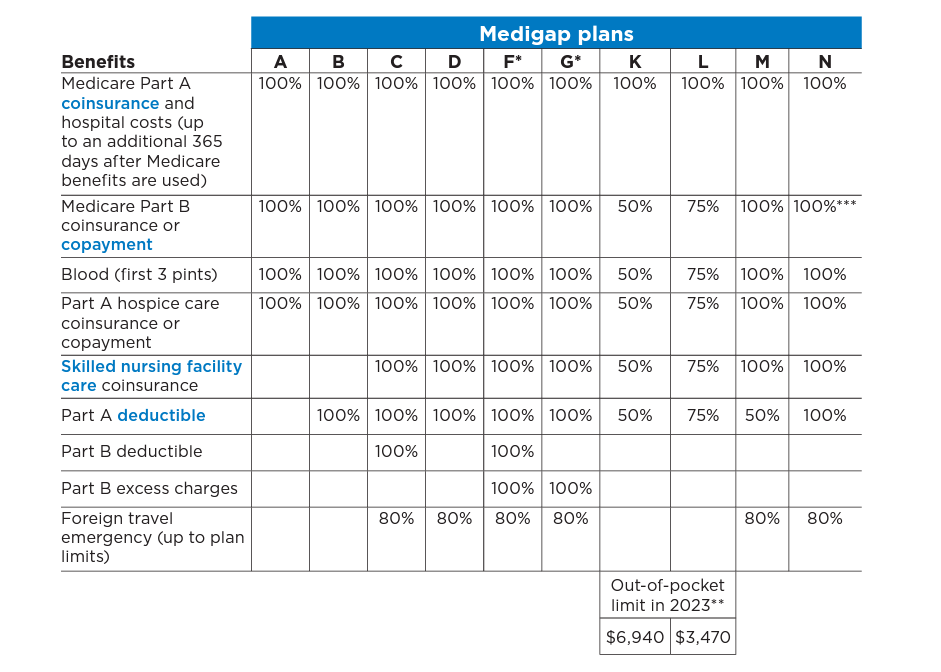

Even though private insurers sell Medigap plans in the Tampa Bay area, federal and state rules standardize coverage. Insurers can offer up to 10 plans, each with a different letter designation.

In most cases, each letter plan has to offer the same benefits, no matter which insurance company sells it. But each company can charge different rates for the same plans.

Look at the next picture, those are all the available plans but most companies only offer a few. The most purchased plans are G & N.

The percentages you see in the boxes are the percent that the plan will pay so you don’t have to.

Don't confuse yourself it's our job to make it simple

"Daniel came over to our house and he was here for just over an hr. He explained everything and showed us all the options and not just one. I would recommend this company to anyone."

Walter James Horton, New Port Richey

" I was under the impression that Supplement plans are expansive but after Daniel showed me how much I was already spending it was a no brainer to have the all the other freedoms which i did not have with my Advantage plan."

Emilia Munrano, Clearwater

" I don't like having to ask for permission where I can and can not go. For $180 per month it was a very simple appointment for Daniel.

Branden Grift, Tampa

We travel a lot to see our kids up north and I wanted something that could travel with me. I don't want to think about if I’m covered just because I’m out of state. I purchased the plan G and I’m paying $173.

Meggie Simon, Westchase

I had an Advantage plan, but I hated the fact that I always had to wait for approval from the insurance company to get my tests done. Plan N works perfect for me.

Martha Leesly, Hudson

We were in PA for Thanksgiving and my husband had a heart attack. It was just a finical mess and once my husband was stabilized the insurance compny made us come back to FL because we were out of network. Never again will I enroll into an Advantage plan even if the pay me.

Sam Marlow, Oldsmar

we’re here to all your questions

How Long Does A Appointment Take?

On Average it takes about 60 – 90 min to go over everything. Sometimes it’s longer and sometimes it’s shorter, it just depends on every situation.

Why should I use an Independent Agent?

We have contracts with several companies which sell Medigap plans in the Tampa Bay Area. The plans are mostly the same but every companies charges different prices. We will find you the most affordable plan in your area.

Do I have to pay anything to the agent?

No, we have nothing to do with the the money. We just find the best plan for your situation and we submit the application to that insurance company. Mostly everything is done electronically these days.

Do you have an office I can come to?

Our office was based in New Port Richey but when covid shut everything down we gave up our office and our agents started working from home like most insurance companies. We had the option to reopen the office but we found that our agents did the same job to the fullest satisfaction of our clients without having to pay rent, utilities and all the other expenses associated with having an office.