Medicare Advantage Explained 2023

As individuals approach their retirement years, understanding healthcare options becomes increasingly important. Medicare, a federal health insurance program, provides coverage for individuals aged 65 and older, as well as certain younger individuals with disabilities. One popular alternative to Original Medicare (Part A and Part B) is Medicare Advantage Plans. In this article “Medicare Advantage Explained 2023“, we will delve into the world of Medicare Advantage, exploring its key features, benefits, enrollment process, and important considerations.

It is my intention to answer most of your questions in this article, but if I miss something please email me at daniel@pascohernandoseniorservices.org and I will answer your question.

What are Medicare Advantage Plans?

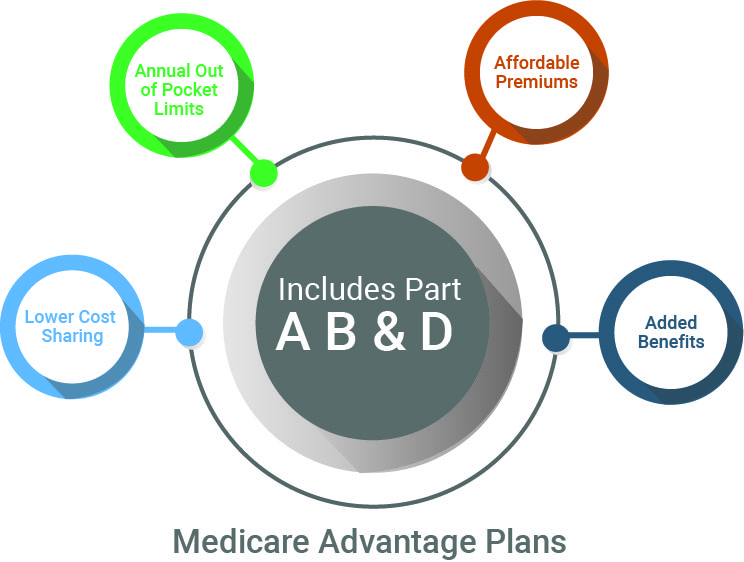

Medicare Advantage Plans, also known as Medicare Part C, are private health insurance plans that offer an alternative to Original Medicare. These plans are approved by Medicare and are required to provide at least the same level of coverage as Original Medicare. However, they often include additional benefits such as prescription drug coverage, dental care, vision care, and wellness programs.

How Does a Medicare Advantage Plan Work?

If you stay with Original Medicare you would show your Medicare card when you receive medical services. When you go to the pharmacy, you would show them your Part D prescription card from whatever company you purchased the prescription plan from. But if you decide that you would like to join an Advantage Plan also known as Part C, all your benefits would be with one company.

Medicare Advantage plans are funded by the federal government through the Medicare program. Here’s how Medicare Advantage plans get paid:

Monthly Payments: The federal government pays Part C plans a fixed amount per enrollee each month. This payment, known as a capitated payment, and is based on the health status and demographics of the plan’s members.

Medicare Premiums: Part C plans receive a portion of the premiums paid by beneficiaries for Medicare Part B coverage. This amount is typically deducted from the monthly capitated payment.

Additional Funding: In addition to the monthly payments, Part C plans may receive additional funding in the form of bonuses or quality incentive payments. These additional payments are based on the plan’s performance in meeting certain quality measures and benchmarks set by the Centers for Medicare & Medicaid Services (CMS).

Cost-Sharing from Enrollees: Part C also collect cost-sharing from enrollees in the form of deductibles, copayments, and coinsurance. These out-of-pocket payments help offset some of the plan’s costs and can vary depending on the specific plan and services received.

In return for these payments, the Part C plan must offer at least the same coverage as offered under original Medicare. The plans must adhere to certain rules and regulations set by Medicare to ensure that they meet the required standards of care and provide value to their members. To enroll more members, most Part C plans go over and beyond the minimum standards by offering Dental, Vision, Gym memberships, meal plans, and many other programs to entice enrollees to join their plan.

Types of Medicare Advantage Plans:

There are several types of Medicare Advantage Plans (Part C), each with its own set of rules and coverage options.

Health Maintenance Organizations (HMOs)

A Health Maintenance Organization (HMO) is a type of plan where enrollees must use healthcare providers within a specific network to receive covered services, except in emergencies. Participants select a primary care physician (PCP) who manages their healthcare needs and coordinates referrals to specialists. HMOs typically have lower out-of-pocket costs, may include prescription drug coverage, and often offer additional benefits such as wellness programs.

Preferred Provider Organizations (PPOs)

A Preferred Provider Organization (PPO) is a type of plan that allows participants to receive covered services from both in-network and out-of-network providers. PPOs have a network of healthcare providers just like HMO’s, but participants have the flexibility to choose providers outside the network for a higher cost.

Private Fee-for-Service (PFFS)

A Private Fee-for-Service (PFFS) plan is a type of plan where participants can receive healthcare services from any Medicare-approved provider who agrees to accept the plan’s payment terms. PFFS plans determine the amount they will pay for each service, and providers can choose to accept or decline the plan’s terms on a case-by-case basis. Participants do not need to choose a primary care physician or obtain referrals to see specialists.

Special Needs Plans (SNPs)

Special Needs Plan (SNP) is a type of plan that provides specialized healthcare coverage for individuals with specific health conditions or unique care needs. SNPs are designed to meet the specific requirements of three main groups: individuals with certain chronic conditions, those who are dual-eligible for both Medicare and Medicaid, and those residing in long-term care facilities.

What are the Benefits of Medicare Advantage Plans?

Medicare Advantage Plans offer several advantages over Original Medicare. These include:

Additional Coverage: Many Medicare Advantage Plans include prescription drug coverage (Medicare Part D) and may offer benefits such as dental, vision, hearing, and fitness programs.

Cost Savings: Medicare Advantage Plans often have lower out-of-pocket costs and annual out-of-pocket maximums, providing financial protection against high healthcare expenses.

Care Coordination: Some plans offer care coordination services to help manage and coordinate healthcare services among different providers, ensuring comprehensive and integrated care. The healthier you are and stay the more money the plan makes. They are literally in the business of keeping you healthy and happy.

What is the Enrollment Process?

Initial Enrollment: Initial enrollment in Medicare Advantage Plans is generally done during the Initial Enrollment Period (IEP), which includes the seven-month period surrounding an individual’s 65th birthday. Enrollment can also occur during the Annual Enrollment Period (AEP) from October 15th to December 7th each year.

Special Enrollment Periods: Certain life events, such as moving to a new service area or losing employer-sponsored coverage, may qualify individuals for a Special Enrollment Period (SEP) outside the standard enrollment periods.

If you have questions about Medicare, don’t hesitate to contact one of our local agents who work in your community. Visit PascoHernandoSeniorServices.org to schedule an appointment.

Considerations and Limitations:

Network Restrictions: Depending on the type of Medicare Advantage Plan, beneficiaries may be required to choose healthcare providers from within the plan’s network. Out-of-network care may not be covered, except in emergency situations.

Geographic Limitations: Medicare Advantage Plans are location-specific, meaning coverage may vary when individuals move or travel outside the plan’s service area. However, some plans offer nationwide coverage.

Prior Authorization: Some Medicare Advantage Plans require prior authorization for certain services or medications. It’s essential to understand these requirements to ensure coverage.

Annual Plan Changes: Medicare Advantage Plans can change their coverage, benefits, and costs each year. It is advisable to review your plan annually during the AEP to ensure it still meets your healthcare needs.

Conclusion:

Medicare Advantage Plans offer an attractive alternative to Original Medicare, providing comprehensive coverage and additional benefits. Understanding the various plan types, enrollment process, benefits, and considerations is crucial for making informed healthcare decisions. As you navigate the Medicare landscape, consider your healthcare needs, budget, and preferences to select the Medicare Advantage Plan that best aligns with your unique circumstances.