Medicare 2024 AEP Guide

Every year, a specific window of time, called the Annual Open Enrollment Period (AEP), allows Medicare beneficiaries to review and change their coverage if needed for the upcoming year. Understanding this period is vital for ensuring you have the right coverage. Our “Medicare 2024 AEP Guide” is designed to be a living document, meaning anything in this guide might update as the government releases updates. Please check back to see if anything has been updated.

This guide will go over the following subjects:

- When is the Medicare Annual Open Enrollment Period?

- Who can participate?

- What can you do during the AEP?

- Why should you review your options?

- How do you review and compare plan options?

- Key considerations when choosing a plan

- What happens if you miss the AEP?

- 2023 Cost Overview

- 2024 Projected Costs & Updates

It is my intention to answer most of your questions in this article, but if I miss something please email me at daniel@pascohernandoseniorservices.org and I will answer your question.

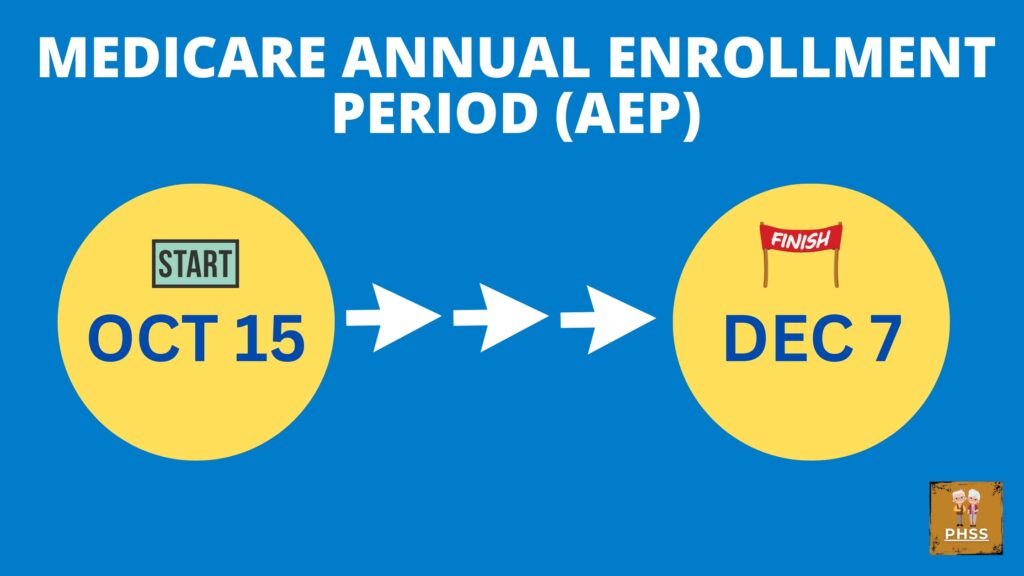

When is the Medicare Annual Open Enrollment Period (AEP)?

The Medicare Annual Open Enrollment Period or as it is simply referred to as AEP runs from October 15 to December 7 each year. Any changes made during this period will become effective on January 1 of the following year.

You can make several changes if necessary anytime before Dec 7th. Whichever plan you have picked when Dec 7th ends is the plan that will become effective on Jan 1st.

Who can participate?

Any Medicare beneficiary can participate in the AEP. If you’re enrolled in Medicare Part A (hospital coverage) and/or Part B (medical coverage), or any Advantage plan (Part C) this period is relevant for you.

What can you do during the AEP?

During the AEP, you can:

Switch from Original Medicare to a Medicare Advantage Plan (Part C) and vice versa.

Change from one Medicare Advantage Plan to another, if you’re already enrolled in one.

Join a Medicare Prescription Drug Plan (Part D) or change your existing Part D plan. If you’re already in a Part D plan and take no action, you’ll remain in that plan unless it’s discontinued.

Drop Medicare prescription drug coverage altogether.

Why should you review your options?

Health needs and available plan options can change annually. Consider the following:

Healthcare needs might have evolved: Your prescriptions or treatments might have changed over the year, making a different plan more cost-effective.

Plan details change: Insurers can modify provider networks, drug formularies (the list of covered drugs), and plan costs.

New plans become available: Insurers may introduce new plans that better cater to your needs.

Annual Notice of Change (ANOC)

Every year, by late September, current enrollees should receive an “Annual Notice of Change” (ANOC) and an “Evidence of Coverage” (EOC) from their current plan provider. These documents detail any changes to your plan for the upcoming year. Review these thoroughly to ensure your current plan still meets your needs.

If you have not received these by the beginning of October, please call your insurance provider and ask to tell them that you have not received them.

How do you review and compare plan options?

To assist beneficiaries, Medicare offers the Medicare Plan Finder tool on the official Medicare website. This online tool helps you:

See a list of plans available in your area.

Compare plans based on coverage, costs, and other features.

Check if your medications are on a plan’s formulary.

It’s wise to approach this tool with a list of your current medications, preferred doctors, and any other specifics about your healthcare preferences.

If you don’t feel comfortable doing all of that yourself, we are here to help you. You can call me directly @727-777-3608, that’s my cell number or give my office a call @727-261-6535 to schedule an appointment with me directly.

If you have questions about Medicare, don’t hesitate to contact us. Visit PascoHernandoSeniorServices.org to schedule an appointment.

Key considerations when choosing a plan

Monthly premium: This is the amount you’ll pay, whether or not you use services.

Deductibles, copayments, and coinsurance: These are your out-of-pocket costs when you access healthcare services.

Coverage of your prescriptions: Ensure the drugs you need are covered and see where they fall on a plan’s formulary. Some tiers have higher out-of-pocket costs than others.

Doctor and hospital choice: If you have preferred healthcare providers, ensure they’re in the plan’s network.

Additional benefits: Some Medicare Advantage plans may offer vision, dental, or hearing coverage.

What happens if you miss the AEP?

If you miss the AEP and wish to make changes to your Medicare Advantage or Part D plans, you’ll likely have to wait until the next AEP the following year. However, certain circumstances may qualify you for a Special Enrollment Period (SEP). Examples of such circumstances include moving out of your plan’s service area, losing your current coverage, or qualifying for Extra Help with drug plan costs, or if the state has a declared emergency declaration for your area which might grant an extension.

Additionally, there’s a Medicare Advantage Open Enrollment Period from January 1 to March 31. During this time, those already in a Medicare Advantage Plan can switch to another Medicare Advantage Plan or switch back to Original Medicare (with an option to join a drug plan).

2023 Overview

Part B

Part B is the medical insurance that covers doctors, durable medical equipment, and so on. Everyone pays a Part B premium, even if you have an Advantage (Part C) plan.

The Part B standard premium is $164.90 per month in 2023. If you have a higher income, you may have to pay more. The Part B deductible is $226 in 2023, you only pay this once per year.

Part A

Copays for inpatient stays in a hospital or skilled nursing facilities are as follows:

$400 per day for days 61 to 90 in a hospital.

$800 per “lifetime reserve day” after day 90 in a hospital, up to a limit of 60 days in your lifetime.

$200 per day for days 21 to 100 in a skilled nursing facility.

Insulin

Insulin costs are limited to $35 a month for Medicare beneficiaries, and there is no deductible.

Starting in July 2023, insulin used with a traditional pump covered by Medicare will also be capped at $35 for a month’s supply.

Medicare Start Dates

If you sign up for Medicare the month of your 65th birthday or during the three months after, your coverage now starts the month after you sign up.

Similarly, if you sign up for Medicare during the general enrollment period from Jan. 1 to March 31 each year, your coverage starts the next month. (It used to start July 1.)

Shingles Vaccines

All adult vaccines covered under Medicare Part D and recommended by the Advisory Committee on Immunization Practices are now covered in full. This includes the shingles vaccine and the whooping cough vaccine.

End-Stage Renal Disease

Medicare beneficiaries with end-stage renal disease used to lose their benefits 36 months after a kidney transplant unless they were otherwise eligible. But now they can apply for immunosuppressive drug coverage through a new benefit called Medicare Part B Immunosuppressive Drug, or Part B-ID.

The premium for this benefit is $97.10 per month in 2023. This benefit covers only continuous immunosuppressive drugs, and these beneficiaries cannot have other health coverage.

2024 Update Overview

Low-Income Subsidy (LIS)

Beginning in 2024, there will no longer be a partial program in the Low-Income Subsidy program or also know as EXTRA HELP. Full benefits will be offered to people with Medicare with limited resources and incomes up to 150 percent of the federal poverty level, which in 2023 is $21,870 per year for an individual. With full benefits, the majority, if not all out-of-pocket costs for prescription medications will be covered. People who qualify for Extra Help will pay:

- No deductible

- No premium

- Fixed lower copays for certain medications

If your income for 2023 is below $22,000 ($30,000 for married couples), you may qualify for lower prescription drug costs. Many people qualify for “Extra Help” with Medicare Part D (drug coverage) and don’t even know it. You can enroll in the Extra Help program by visiting SSA online at ssa.gov/extrahelp or call 1-800-772-1213.

Part D in 2024

Beginning in 2024, the five percent prescription cost-sharing obligation for Part D will be removed. Currently, when someone on Medicare has spent around $3,100, they will enter what’s called the catastrophic phase of their benefit. In this phase, they will have to pay five percent of prescription costs for the rest of the year, without a maximum limit. According to a 2022 Kaiser Family Foundation brief, the changes will be like having a cap of about $3,250 for the calendar year.

In 2024, after paying the initial deductible, a person on Medicare will pay 25 percent of drug costs. They will have a cap of about $3,250 (projected) and will no longer pay five percent of drug costs in the catastrophic phase.

Part B in 2024

The Medicare trustees projected in March 2023 that the standard monthly Part B premium may increase to $174.80 in 2024, an almost $10 monthly increase from the $164.90 standard monthly premium beneficiaries are currently paying.

NEW Medicare Appointment Rules

Technology is growing quickly, allowing people to do much of their decision-making via online resources like Medicare.gov. But research has shown that most people still prefer to sit down with a local agent who can help them make the right decision.

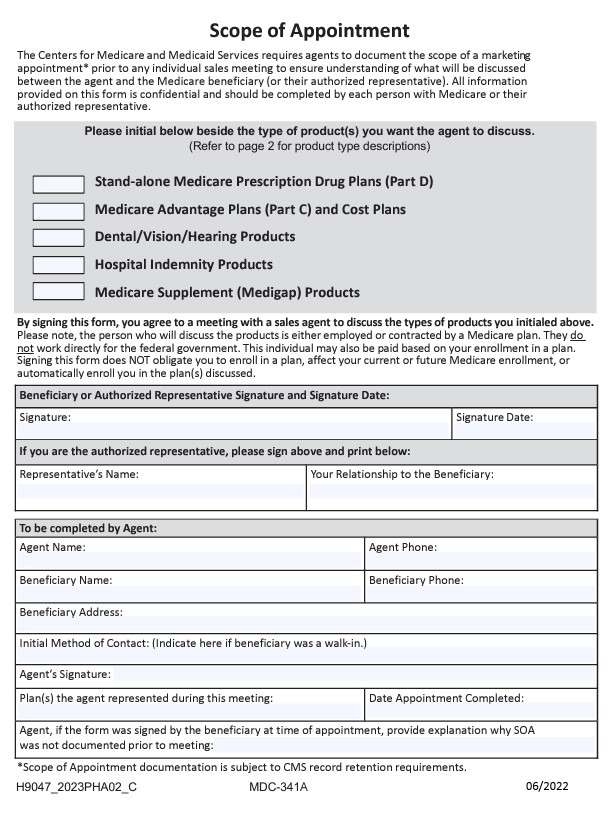

Medicare wants to protect you and one of those ways is to make you fill out a Scope Of Appointment Form before you meet with your agent. The Scope of Appointment is a form that beneficiaries must sign to outline the topics that are allowed to be discussed during a scheduled meeting.

This helps ensure that the beneficiary stays in control, helps them make informed decisions about their benefits, and can prevent misleading marketing tactics.

With the 2024 CMS Rule, there must be a 48-hour waiting period between the signing of the SOA form and the meeting or call between the agent and the Medicare member.

The 48-hour rule applies to all Medicare appointments between a Medicare member and an insurance agent or agency/insurance company starting September 30, 2023.

It is required any time an insurance agent or broker wants to meet with a current or prospective Medicare beneficiary to discuss plans and benefits.

There are two exceptions to this rule. The first exception is during the last four days of an election period when you can obtain a same-day scope of appointment. The second exception is for “walk-in” meetings initiated by the beneficiary, let’s say you walk into an insurance agents brick and mortar office.

It is my intention to answer most of your questions in this article, but if I miss something please email me at daniel@pascohernandoseniorservices.org and I will answer your question.