2024 Medicare Parts A, B, and D Premiums and Deductibles

Every year there is something new with Medicare. As of January 2024, 65,636,490 people were enrolled in Medicare. Staying up to date is important for premiums and deductibles so every year I write an article including this year “2024 Medicare Parts A, B, and D Premiums and Deductibles” that simply goes over the changes without anything else.

This will go over the following:

- Medicare and You 2024 Handbook

- 2024 Medicare Premiums, Deductible, and Copays.

I intend to answer most of your questions in this article, but if I miss something please email me at daniel@pascohernandoseniorservices.org and I will answer your question.

Medicare and You 2024

Medicare & You is the official U.S. government Medicare handbook. If you don’t read a lot or you don’t follow the news, this book is one you should have no matter what.

Medicare releases the Medicare & You handbook annually in late September. You can download the latest version at any time, and you can also sign up to receive it electronically. If you sign up electronically, you’ll receive a link to the PDF version each fall. You can sign up by May 31st to receive the next fall’s handbook electronically.

The Medicare & You handbook is available in many different formats and languages, including large print, braille, English, and Spanish. It contains information about Medicare benefits, costs, rights, and protections, as well as health and drug plans, and answers to common questions.

You can contact Medicare through the Online Help Desk or call a Medicare representative at 1-800-Medicare

2024 Medicare Premiums, Deductible, and Copays.

On October 12, 2023, the Centers for Medicare & Medicaid Services (CMS) released the 2024 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs, and the 2024 Medicare Part D income-related monthly adjustment amounts.

Medicare Part A Premium and Deductible

Medicare Part A covers inpatient hospitals, skilled nursing facilities, hospice, inpatient rehabilitation, and some home health care services. About 99% of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment, as determined by the Social Security Administration.

The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted to the hospital will be $1,632 in 2024

Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care. In 2024, beneficiaries must pay a coinsurance amount of $408 per day for the 61st through 90th day of a hospitalization and $816 per day for lifetime reserve days (90-150).

For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be $204.00 in 2024

Enrollees age 65 and older who have fewer than 40 quarters of coverage and certain persons with disabilities pay a monthly premium in order to voluntarily enroll in Medicare Part A. Individuals who had at least 30 quarters of coverage or were married to someone with at least 30 quarters of coverage may buy into Part A at a reduced monthly premium rate, which will be $278 in 2024.

Certain individuals who have less than 30 quarters of coverage and certain individuals with disabilities who have exhausted other entitlement will pay the full premium, which will be $505 a month in 2024.

Medicare Part B Premium and Deductible

Medicare Part B covers physicians’ services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

Each year, the Medicare Part B premium, deductible, and coinsurance rates are determined according to provisions of the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $174.70 for 2024

The annual deductible for all Medicare Part B beneficiaries will be $240 in 2024

Medicare Part B Income-Related Monthly Adjustment Amounts

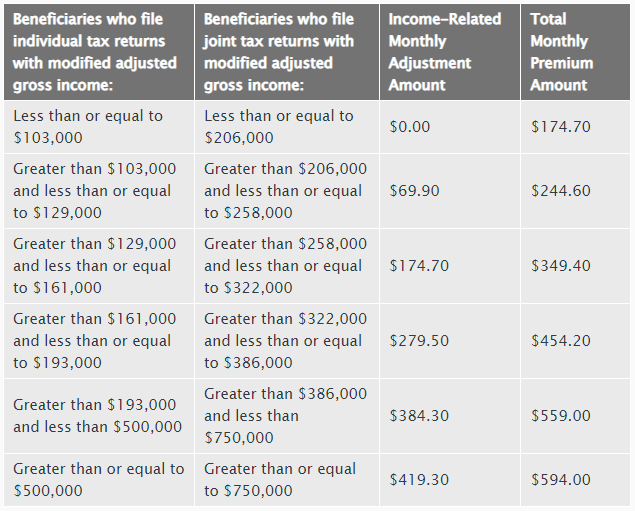

Since 2007, a beneficiary’s Part B monthly premium has been based on his or her income. These income-related monthly adjustment amounts affect roughly 8 percent of people with Medicare Part B. The 2024 Part B total premiums for high-income beneficiaries with full Part B coverage are shown in the following table:

Part D Premium and Deductible

While Part D provides important benefits, it’s not free for most people. Below are some of the out-of-pocket expenses you can expect to pay in 2024.

Most people who are enrolled in a Part D plan (and not eligible for the Part D Low-Income Subsidy (LIS or “Extra Help”)—are responsible for certain expenses. These may include:

- A monthly Part D plan premium (average estimated premium in 2024 is $55.50)

- An annual deductible (maximum $545 in 2024)

- A copayment or coinsurance during the initial coverage period

- A percentage of the cost of drugs (25%) once you pass the initial coverage period and enter what used to be called the coverage gap

Starting in January 2024, LIS/Extra Help will further reduce out-of-pocket costs for people with incomes between 135-150% of the Federal Poverty Level (FPL). It will eliminate “partial” subsidies and replace them with “full” subsidies. Enrollees will no longer pay a premium if they’re enrolled in a benchmark plan. Also, they will have fixed, lower copayments (up to $4.50 for generic and $11.20 for brand-name drugs in 2024) and no deductible.

Medicare Part D Income-Related Monthly Adjustment Amounts

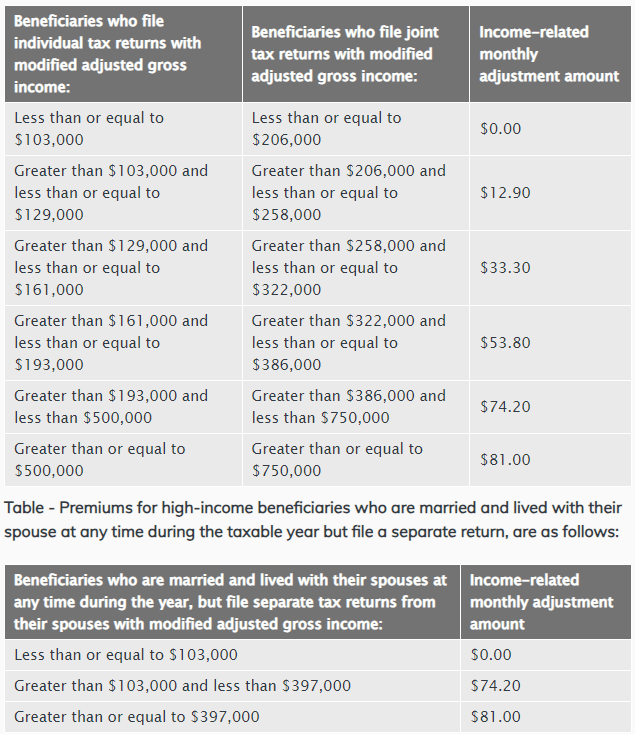

Since 2011, a beneficiary’s Part D monthly premium has been based on his or her income. These income-related monthly adjustment amounts affect roughly 8 percent of people with Medicare Part D. These individuals will pay the income-related monthly adjustment amount in addition to their Part D premium.

Part D premiums vary plan and regardless of how a beneficiary pays their Part D premium, the Part D income-related monthly adjustment amounts are deducted from Social Security benefit checks or paid directly to Medicare. Roughly two-thirds of beneficiaries pay premiums directly to the plan while the remainder have their premiums deducted from their Social Security benefit checks. The 2024 Part D income-related monthly adjustment amounts for high-income beneficiaries are shown in the following table:

I intend to answer most of your questions in this article, but if I miss something please email me at daniel@pascohernandoseniorservices.org and I will answer your question.