What Is Long-Term Care?

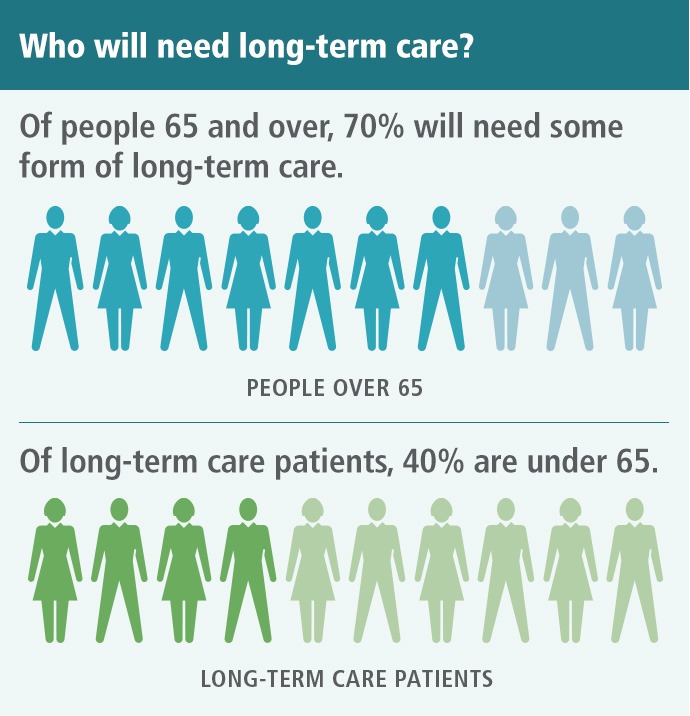

Don’t worry, this article does not apply to you it only applies to the 70% of other people around you. This is usually how the conversation goes when you try to talk to someone about Long-Term Care. It always happens to “other” people, right!!

70% of people will require long-term care at some point in their lives. The average length of stay in long-term care is 3.2 years. Long-term care is something we may not think about until we or our loved ones need it at which point it’s too late to put something in place to protect the hard-earned money you have saved up.

In this article “What is Long-Term Care“, I will do my best to explain everything you need to know so that you can make the right decision and hopefully start planning for it today. It is a very detailed articled and might be a little longer than usual but It’s what you need to know to start planning. It’s worth the time it will take you to read it.

We will go over the following:

- What is Long-Term Care?

- Who Will Need Long-Term Care?

- Where is Long-Term Care Provided?

- Government Programs To Pay For Long-Term Care

- Private Financing Options

- Planning for Long-Term Care

I intend to answer most of your questions in this article, but if I miss something please email me at daniel@pascohernandoseniorservices.org and I will answer your question.

What is Long-Term Care?

Long-term care (LTC) is a range of services designed to help people with everyday activities they can no longer do on their own due to illness, disability, or cognitive impairment. These activities, known as activities of daily living (ADLs), include things

- Bathing

- Dressing

- Eating

- Grooming

- Using the toilet

- Moving around, such as moving from a bed to a chair

70% of adults aged 65 years and older will require long-term care at some point and 40% of all long-term patients are younger then 65. The average length of stay in long-term care is 3.2 years. Over 20% of people will require care for 5 years or longer. Americans spend $475.1 billion annually on long-term care. For the people that qualify for Medicaid, it only covers 54% of the costs.

Who will need Long-Term Care?

The need for long-term care can arise after a heart attack or stroke or a debilitating car accident. More often, however, the need for long-term care comes gradually as people require more care as they get older or as a serious, ongoing illness or health condition gets worse. Overall, women live longer than men, they have a greater likelihood of needing long-term care.

The need for long term care impacts the entire family, not just a person. For example, if your child is taking care of you, it may bring you closer together in some way. But providing that care can be time-consuming, stressful, or exhausting for a caregiver. It also takes them away from their own obligations including their children, their spouses, and their job.

Long-term care is one of those conversations we need to have when it seems the farthest away. The younger and healthier you are the easier and cheaper it is to find a plan that will work for your lifestyle. From experience, we see that mostly people in their late 40s or to mid-50s seem to start thinking the most about protecting their nest egg from this potential financial catastrophe. It’s never too early to protect yourself, your loved ones, and your savings account and investments.

Where is Long-Term Care Provided?

Most people want to receive long-term care services in the home they’ve always lived in, but that option isn’t always right depending on the need.

In-home Care Options:

Hands-Off Care – assist with cooking, cleaning, and running errands.

Home Health Aide Services

(Hands-On Care) – assist with bathing, dressing, eating, and medication, etc.

Community Option:

Social and support services are provided in a community setting. Participants can join in planned activities with caregivers looking after them. Some programs also include personal care, transportation, medical management, and meals.

Facility Options:

Assisted Living Facility –

Personal care and health services are provided in a residential facility. The level of care is not as extensive as a nursing home. People consider assisted living when they don’t need care around the clock.

Nursing Home –

Residential facilities provide a higher level of supervision and care when people need more help with their day-to-day activities. Personal care, lodging, supervision, help with medication, therapy, and rehabilitation are all provided on-site, 24 hours a day.

There are 691 licensed nursing homes in Florida, representing approximately 84,448 beds . The estimated number of residents is 71,000 (roughly 85% occupancy at any given time).

How much does long-term care insurance cost?

The median annual cost of care for a private room in a nursing center in Florida is $8,364.58 per month or $100,375 per year or $7,441 per month or $89,297 for a semi-private room.

The median annual cost for care for a private room in an assisted living facility is on average $4000 per month or $48,000 per year.

In-home care costs are billed by the hour. The more hours of home care a senior needs each week, the higher the cost.

The median cost of home care is between $30 – $40 an hour. This cost varies by agency and location.

Home care costs vary by state. Median state costs range from $21 an hour to $50 an hour.

Full-time home care is more expensive than assisted living but less expensive than nursing homes. These numbers may change based on how much care your loved one needs and where you live.

If you live in Pasco, Hernando, Pinellas, or Hillsborough county, we would love to help you with anything regarding Medicare or Final Expense related. Since 2012 we have been helping others just like you in our community be more prepared for the future.

You can give us a call right now 727-261-6535 to talk to my wife Shannon, she runs everything in our office and she will help you with all your options. If you prefer in-person conversation you can call or text me directly on my cell phone 727-777-3608.

Government Programs To Pay For Long Term Care

Many caregivers and older adults worry about the costs of long-term care. These expenses can use up a significant part of monthly income, even for people who thought they had saved enough. How people pay for long-term care depends on their financial situation and the kinds of services they use.

Some people believe that their current health or disability insurance will pay for their long-term care needs, but most of these insurance policies include limited, if any, long-term care benefits. In most cases, people must find other means of paying for long-term care. They may rely on a variety of payment sources, including personal funds, federal and state government programs, and private financing options. Read on to find out more about each of these options.

Medicare – Medicare, including Medicare Supplement Insurance (Medigap), don’t pay for long-term care.

Source: https://www.medicare.gov/coverage/long-term-care

Nursing Home Medicaid – Medicaid eligibility is based on your income and personal resources. Florida residents have to meet an asset limit and an income limit in order to be financially eligible for Nursing Home Medicaid.

For a single applicant in 2024, the asset limit is $2,000, which means they must have $2,000 or less in assets. Countable assets include bank accounts, retirement accounts, stocks, bonds, certificates of deposit, cash and any other assets that can be easily converted to cash. An applicant’s home does not always count as an asset, and there are other non-countable assets, like Irrevocable Funeral Trusts and Medicaid Compliant Annuities.

The 2024 income limit for Florida Nursing Home Medicaid for a single applicant is $2,829/ month. Almost all income is counted – IRA payments, pension payments, Social Security benefits, property income, alimony, wages, salary, stock dividends, etc.

For married applicants with both spouses applying, the 2024 asset limit for Florida Nursing Home is a combined $3,000, and the income limit is a combined $5,658/month.

For a married applicant with just one spouse applying, the 2024 asset limit is $2,000 for the applicant and $154,140 for the non-applicant spouse. The 2024 income limit is $2,829/month for the applicant, and the income of the non-applicant spouse is not counted.

Florida Nursing Home Medicaid is an entitlement program. This means all qualified applicants are guaranteed by law, aka “entitled,” to receive benefits without waiting. In Florida, Nursing Home Medicaid beneficiaries are required to give up most of their income to the state to help cover expenses. They are allowed to keep a “personal needs allowance” (PNA) of $160/month (as of July 1, 2023), which can be spent on personal items such as clothes, snacks, books, haircuts, etc. Not all nursing homes accept Medicaid, you may not be guaranteed a facility with space close to where you live now.

Florida’s Statewide Medicaid Managed Care (SMMC) Long-Term Care (LTC) Waiver Program – SMMC-LTC can help pay for long-term care services and remain living in the community instead of moving to a nursing home. Living “in the community” can mean living in their home, the home of a loved one, an adult family care home or an assisted living residence. While the SMMC LTC Program covers some long-term care benefits in those settings, it will not cover room and board costs.

Unlike Nursing Home Medicaid, Florida’s SMMC LTC Program is not an entitlement. Instead, the program has a limited number of enrollment spots (107,875 as of 2023), and once those spots are full additional applicants will be placed on a waitlist. The financial requirements for SMMC LTC are the same as for Florida Nursing Home Medicaid.

Florida’s Medicaid for Aged and Disabled (MEDS-AD) – Eligible Florida seniors who show a medical need for long-term care goods and services can receive those goods and services through MEDS-AD. These benefits can include in-home personal care, adult day care, meal delivery, home modifications and Personal Emergency Response Systems (PERS). MEDS-AD recipients qualify for these benefits one at a time. This is different from Nursing Home Medicaid, which makes all of its benefits immediately available for anyone who qualifies. Instead, Florida seniors will be evaluated by the state to determine what kind of long-term care benefits they need and will receive.

The asset limit for a single applicant from April 2024 to March 2025 is $5,000, which means they must have $5,000 or less in countable assets. Countable assets include bank accounts, retirement accounts, stocks, bonds, certificates of deposit, cash and any other assets that can be easily converted to cash. The income limit for MEDS-AD for a single applicant from April 2024 to March 2025 is $1,104/month. Almost all income is counted. For married applicants from April 2024 to March 2025, the asset limit for MEDS-AD is a combined $6,000, and the income limit is a combined $1,492/month. These limits are used for both married couples with both spouses applying for MEDS-AD and married couples with only one spouse applying.

Applying For Florida Medicaid Long-Term Care Programs

1. The first step in applying for a Florida Medicaid Long Term Care program is deciding which programs you want to apply for – Nursing Home Medicaid, Statewide Medicaid Managed Care (SMMC) Long-Term Care (LTC) or Medicaid for Aged and Disabled (MEDS-AD).

2. The second step is to meet the financial and functional criteria. If you don’t qualify you will be simply be denied.

3. During the process of financial eligibility, it’s important to start gathering documentation that details your financial situation. These documents will be needed for the application. Necessary documents include tax forms, Social Security benefits letters, deeds to the home, proof of life insurance, and quarterly statements for all bank accounts, retirement accounts, and investments. For a complete list of documents you might need to submit with your Medicaid Long Term Care application, go to our Medicaid Application Documents Checklist.

Program of All-Inclusive Care for the Elderly (PACE)

Some states offer PACE, the Program of All-Inclusive Care for the Elderly. It is a combined Medicare and Medicaid program that provides services to people who otherwise would need care in a nursing home. PACE enables most people who qualify to continue living at home instead of moving to a long-term care facility. The program helps cover the costs of medical care, social services, and long-term care for frail older adults. Participants receive coordinated care from a team of health care professionals.

You will need to find out if the person who needs care qualifies for PACE and if there’s a PACE program near you. PACE is available only in certain states and in specific locations within those states.

No financial criteria are considered in determining eligibility. However, individuals cannot be enrolled in a Medicare Advantage (Part C) plan, a Medicare prepayment plan, or a Medicare prescription drug plan. They cannot be enrolled in hospice services or certain other programs.

To find out more, contact Medicare at 800-633-4227 or visit Medicare’s PACE page. You can also search for local programs by state using PACEFinder, an online service of the National PACE Association.

Conclusion for Government Programs

Do you wonder which benefit programs would be most helpful for you or a family member? Do you have questions about eligibility? Do you need to learn how to sign up?

Benefits.gov is the federal government’s official benefits website. It offers numerous state and local resources for health care and financial assistance. The Benefits Finder questionnaire can help you find specific benefits and learn where to apply for them. You can also call 800-FED-INFO (800-333-4636) for information about government benefits.

The National Council on Aging’s free service called BenefitsCheckUp can help you find public and private benefit programs by location, category, and eligibility. This service can help you learn more about benefits programs before applying and find contact information for the agency that offers each program.

Private Financing Options

In addition to personal funds and government programs, there are several private payment options, including long-term care insurance, reverse mortgages, certain life insurance policies, annuities, and trusts. Which option is best depends on many factors, including the person’s age, health status, and financial situation.

Long Term Care Insurance

Long Term Care Insurance covers services and support for people needing long-term care, including help with the activities of daily living. Policies cover a wide range of benefits in a variety of settings, including the person’s home, an assisted living facility, or a nursing home. The exact coverage depends on the type of policy and the services it includes. Make sure you understand what your policy does and does not cover, and how long benefits last.

Many companies sell long-term care insurance. Costs and benefits vary, so it’s a good idea to shop around and compare policies. The cost of a policy is based on the type and amount of services, how old the person is when they buy the policy, and any optional benefits. Some employers are starting to offer group long-term care insurance programs as a benefit. It may be easier to qualify for long-term care insurance through an employer-sponsored program, and group rates may be cheaper than the cost of an individual policy.

Buying long-term care insurance can be a good choice but it’s important to have this conversation early on because costs go up for people who are older, have health problems, or want more benefits. Someone who is in poor health or already receiving end-of-life care services may not qualify for long-term care insurance.

Reverse Mortgages

A reverse mortgage is a special type of home loan that lets a homeowner convert part of the ownership value in their home into cash without having to sell the home. Unlike a traditional home loan, no repayment is required until the borrower sells the home, no longer uses it as a main residence, or dies.

There are no income or medical requirements to get a reverse mortgage, but this option is only available to those age 62 or older. The loan amount is tax-free and can be used for any expense, including long-term care. However, if the person has an existing mortgage or other debt against their home, they must use the funds to pay off those debts first.

Additional information about reverse mortgages and other borrowing options is available from the Consumer Financial Protection Bureau or by calling 855-411-2372.

Life Insurance

Some life insurance policies can help pay for long-term care. Companies are starting to offer a combination product that includes both life insurance and long-term care insurance.

Policies with an “accelerated death benefit” provide tax-free cash advances while a person is still alive. The cash advance is subtracted from any proceeds that beneficiaries receive after the person dies. A person can get an accelerated death benefit if they live permanently in a nursing home, need long-term care for an extended time, are terminally ill, or have a life-threatening diagnosis. Check the life insurance policy to see exactly what it covers and when the older person can access the benefits.

Selling a life insurance policy for its current value can be another way to raise cash. This option, known as a “life settlement,” is usually available only to women age 74 and older and men age 70 and older. The proceeds are taxable and can be used for any reason, including paying for long-term care.

Similar arrangement, called a “viatical settlement,” allows a terminally ill person to sell their life insurance policy to an insurance company for a percentage of the death benefit on the policy. This option is typically used by people who are expected to live two years or less. A viatical settlement provides immediate cash and is tax-free, but it can be difficult to obtain. Companies decline more than half of the people who apply.

Keep in mind that if a person chooses to take life insurance benefits early or to sell their policy, there will be little or no money left from the policy to pass on to heirs.

Annuity

An annuity is an insurance contract in which you pay a premium, either upfront or monthly, to receive payments back from the insurance company at a later date. An annuity can be immediate, meaning your annuity payments begin within a year of paying the initial premium. Or it may be deferred, with payments beginning at a specified date in the future

A long-term care annuity is a deferred annuity that includes a long-term care rider. A rider is essentially an add-on you can include when purchasing an annuity that offers extra features or benefits. You purchase the annuity with the long-term care rider and when you eventually need long-term care, you can begin receiving payments to help with those expenses. Payments can be made to you monthly or as a lump sum. Your annuity company can give you the money to use as needed or reimburse you after the fact for long-term care expenses you’ve already paid.

Annuities grow with interest and a long-term care annuity can either be fixed or variable. With a fixed annuity, you’re earning a guaranteed rate of return. This type of annuity is generally considered a safe investment since your returns are predictable. A variable annuity tends to be riskier but it offers the opportunity to earn higher returns if the underlying investments perform well.

If you have an existing health issue, you might find it easier to get approved for an annuity with a long-term care rider versus long-term care insurance. If you would like to have that conversation, you can give us a call right now at 727-261-6535 to talk to my wife Shannon, she runs everything in our office and she will help you with all your options. If you prefer in-person conversation you can call or text me directly on my cell phone at 727-777-3608.

Trust

One way to plan financially for long-term care is to create a trust. It can be an incredibly useful tool to protect your assets if you qualify for certain long-term care benefits. There are revocable trusts, those are trusts you can change. There are irrevocable trusts and these trusts can’t change.

Revocable trusts are often used for two purposes. One is to avoid probate. But they’re also really good for asset management, financial management in the event of incapacity because the trustee can step in and manage your affairs if you have your assets in a trust and do it relatively seamlessly.

You can also keep an eye on people, one thing that often happens to people as they age is they become victims of fraud. If you have a co-trustee on the trust, they can see what’s going on and make sure that if all of a sudden money in an account is being depleted, that stops.

Irrevocable trusts you cannot change after they’re set up, and they’re used for different kinds of long-term care planning. It’s really Medicaid planning because you can create a trust that shelters assets. Once the assets are in the trust, they won’t be counted in determining whether you’re eligible for benefits. Then the assets in the trust, when you die, won’t be subject to Medicaid estate recovery at that point for the state to get its money back.

Planning for Long-Term Care

It may be difficult for healthy people in their 40s, 50s, and 60s to envision a time in the future when they need long-term help to care for themselves or their spouse. Contemplating losing the ability to live independently later in life is also likely to raise anxiety, both about what may happen to you and about the financial implications. Many realize later that being able to afford and receive care in the privacy of their own home—near family members—or in an external facility is a significant component of financial planning.

Long-term care is something many of us will need during our lifetime. Poor planning can have a significant financial impact on the people we love most.

Long-term care planning for families often can be complex, and people may tend to avoid discussing it because it can be an emotional topic with important questions about the financial implications of extended care.

A good starting point for the conversation could be asking yourself and others: If something were to happen today, or 10 to 20 years from now, who do you want in charge of your care? Would that be a family member, a spouse, partner, or might it involve hiring someone to take on that role?

You have to consider what that might do to your relationship if you have this change in dynamic, some spouses or family members may not be comfortable with the duties and change in relationship dynamics, and they might prefer to have someone else do the work. Don’t assume that they will know how to do it or that they will have to time to do it if they have there own family to take care of. Not everyone may be able to count on family or a partner for their extended-care needs and in this case you have to make sure you will have to ability to pay for professional help.

Knowledge is the key to success.

Professional help is crucial in saving time, money and stress.

When money is available for care, caregiver stress is reduced and care options are expanded.

Success is assured through a written agreement with all parties involved.

To start planning for Long-Term Care needs you first need to start with a simple conversation with the people around you.

“What is our plan if _____ happens?”

I intend to answer most of your questions in this article, but if I miss something please email me at daniel@pascohernandoseniorservices.org and I will answer your question.