What is a Health Savings Account (HSA)?

In today’s complex world of healthcare and finance, understanding your options for saving money and covering medical expenses can be overwhelming. One option that’s gaining popularity is the Health Savings Account (HSA). But what exactly is an HSA, and how can it benefit you? Let’s break it down in simple terms in this article “What is a Health Savings Account (HSA)?

This will go over the following:

- What is a Health Savings Account (HSA)?

- Who is eligible for an HSA?

- How does an HSA work?

- What are the benefits of having an HSA?

- Examples to illustrate how an HSA works:

I intend to answer most of your questions in this article, but if I miss something please email me at daniel@pascohernandoseniorservices.org and I will answer your question.

What is a Health Savings Account (HSA)?

A Health Savings Account (HSA) is a special type of savings account that allows individuals to set aside pre-taxed money to pay for qualified medical expenses. It’s like a piggy bank specifically for healthcare costs.

To use an HSA with your health insurance plan, you need to enroll in a Qualified High Deductible Health Plan (QHDHP). It’s important to know that not all high-deductible health plans are qualified. The Internal Revenue Service (IRS) defines what makes a plan qualified.

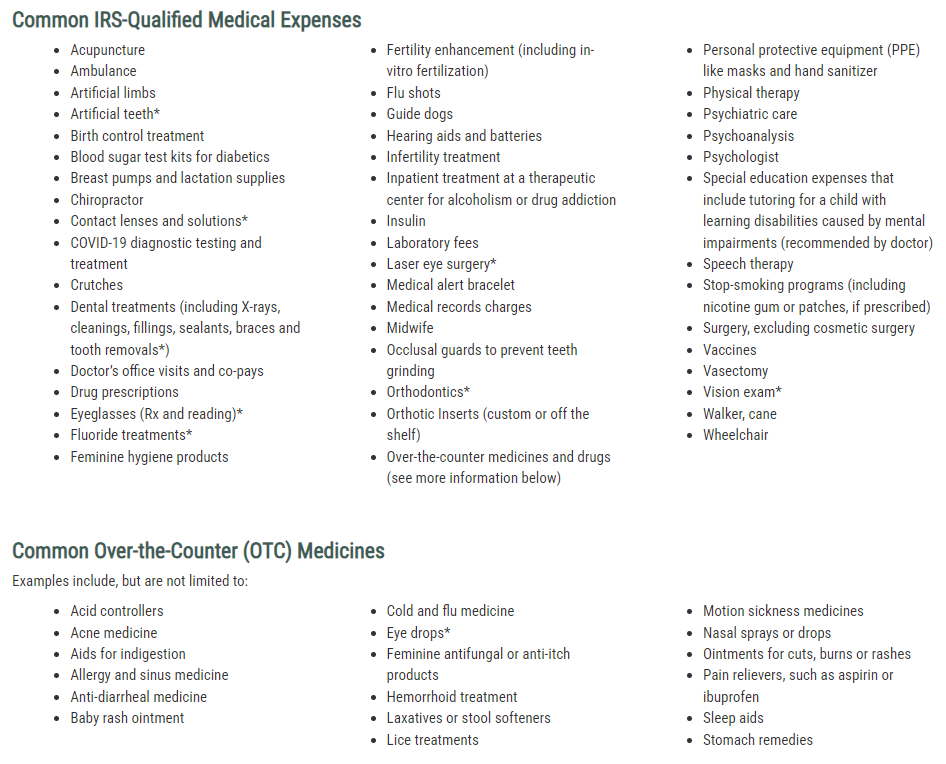

The following picture shows a basic summary of common expenses that can be paid with a Health Savings Account (HSA). Due to frequent updates to the regulations this list is to be utilized as a guide only which may change at any time. For more information on IRS-qualified medical expenses, click here.

Who is eligible for an HSA?

You are eligible for an HSA if you are:

- Enrolled in a High Deductible Health Plan (HDHP) and are not covered by another health plan like for example a spouse’s health plan.

- Not enrolled in Medicare

- Not in receipt of VA or Indian Health Service (IHS) medical benefits within the last three months

- Not covered by your own or your spouse’s flexible spending account (FSA), and are not claimed as a dependent on someone else’s tax return

How does an HSA work?

You contribute money to your HSA either through payroll deductions if offered by your employer or directly if you have an individual HSA. The money you contribute is not subject to federal income tax when deposited into the account. If you deposit money into your HSA directly and since that money has already been taxed you will be able to write that amount off on your taxes to reduce your taxable income.

You can use the funds in your HSA to pay for qualified medical expenses, such as doctor’s visits, prescriptions, and even some over-the-counter items. Any unused funds in your HSA can roll over from year to year.

If you withdraw money from your HSA for non-medical expenses before age 65, you may have to pay income tax on the amount withdrawn plus a penalty. However, after age 65, you can withdraw funds for non-medical expenses without penalty, although you’ll still owe income tax.

What are the benefits of having an HSA?

- Tax advantages: Contributions to your HSA are tax-deductible, reducing your taxable income. Additionally, any interest or investment earnings on the money in your HSA grow tax-free.

- Savings for the future: Since the money in your HSA rolls over from year to year, you can build up a substantial balance over time to use for future medical expenses, including in retirement.

- Control over healthcare spending: With an HSA, you have more control over how you spend your healthcare dollars. You can use the funds for a wide range of medical expenses, including those not covered by insurance, such as dental and vision care.

Examples to illustrate how an HSA works:

- Tax savings: Let’s say you contribute $3,000 to your HSA over the course of a year. If you’re in the 22% tax bracket, you’ll save $660 on your federal income taxes ($3,000 x 0.22 = $660).

- Rolling over funds: You contribute $3,000 to your HSA this year but only use $500 for medical expenses. The remaining $2,500 rolls over to the next year, allowing you to start with a balance of $2,500.

- Using for non-medical expenses after age 65: You’re 66 years old and want to take a trip around the world. You withdraw $5,000 from your HSA to cover travel expenses. Since you’re over 65, you don’t have to pay a penalty on the withdrawal, but you’ll owe income tax on the $5,000.

A Health Savings Account (HSA) is a valuable tool for managing healthcare costs and saving money for the future. By understanding how an HSA works and taking advantage of its benefits, you can take control of your healthcare expenses and plan for a healthier financial future.

If you live in Pasco, Hernando, Pinellas, or Hillsborough county, we would love to help you with anything regarding Medicare or Final Expense related. Since 2012 we have been helping others just like you in our community be more prepared for the future.

You can give us a call right now 727-261-6535 to talk to my wife Shannon, she runs everything in our office and she will help you with all your options. If you prefer in-person conversation you can call or text me directly on my cell phone 727-777-3608.

I intend to answer most of your questions in this article, but if I miss something please email me at daniel@pascohernandoseniorservices.org and I will answer your question.