Medicare Supplement Plan N

Medicare Supplement Plan N is a critical insurance policy that fills the gaps in Original Medicare (Part A and Part B) coverage. It offers essential coverage for out-of-pocket costs that Original Medicare doesn’t cover. This article provides an in-depth analysis of Medicare Supplement Plan N, helping you make an informed choice.

This article will go over the following subjects:

- What is Medicare Supplement Plan N?

- What does Plan N cover?

- What does Plan N NOT cover?

- How much does Plan N Cost?

- Yearly Premium Increases

- Who can enroll in Plan N?

- When can you enroll in Plan N?

- Medigap Plans & Advantage Plan (Part C)

It is my intention to answer most of your questions in this article, but if I miss something please email me at daniel@pascohernandoseniorservices.org and I will answer your question.

What is Medicare Supplement Plan N?

If you have Original Medicare Part A & B you should know that it does not cover all your medical costs when you go to the hospital or doctors. Original Medicare covers most of the time 80% of the bill, leaving you to pay the rest. The 20% of the bill which you are responsible for can amount to a lot of money if you have a hospital stay or ongoing medical condition that needs care.

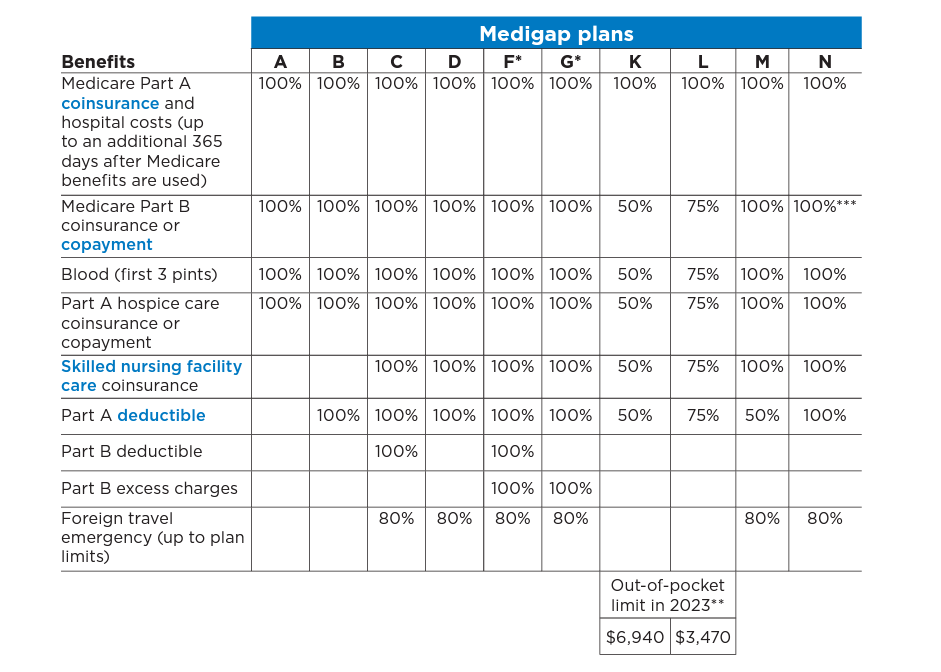

Medicare Supplement Plan N, also referred to as Medigap Plan N, is one of the 10 standardized Medigap policies available in most states across the U.S.

Don’t let all the different options overwhelm you or scare you, most people choose between 3 different plans and N is one of them, and not all plans are available everywhere.

Some Medigap policies also offer coverage for services that Original Medicare doesn’t cover, like medical care when you travel outside the U.S. Generally, Medigap doesn’t cover long-term care (like care in a nursing home), vision or dental services, hearing aids, eyeglasses, or private-duty nursing.

Medigap plans sold to people who are new to Medicare on or after January 1, 2020, aren’t allowed to cover the Part B deductible. Because of this, Plans C and F are no longer available to people new to Medicare on or after January 1, 2020.

We are here to help you

If you get confused about any of this at any time, don’t worry. PHSS is here to help you. If you live in the Tampa Bay area, your local agent can come to you just like your plumber or electrician does. He or she will answer any questions you might have about Medicare and help you sort everything out so that you are protected.

Just click on the next picture and schedule a time.

What does Medicare Supplement Plan N Cover?

Medicare Supplement Plan N provides several key coverages:

Part A Deductible

It pays for the Medicare Part A deductible

Part A Coinsurance and Hospital Costs

It covers 100% of Medicare Part A coinsurance. Your Plan N will also pay for an additional 365 days of hospital stays after Medicare benefits run out.

Part B Coinsurance & Copayments

Plan N covers 100% of Medicare Part B coinsurance costs, except for a copayment of up to $20 for doctor visits and up to $50 for emergency room visits.

Blood

The first three pints of blood for a medical procedure are covered under Plan N.

Part A Hospice Care Coinsurance or Copayment:

The first three pints of blood for a medical procedure are covered under Plan N.

Part A Hospice Care Coinsurance or Copayment

It covers all of the hospice care coinsurance or copayments.

Skilled Nursing Facility Care Coinsurance

Plan N covers skilled nursing facility care coinsurance costs.

Foreign Travel Emergency

Plan N covers 80% of emergency medical care during foreign travel, subject to plan limits.

What does Plan N NOT cover?

Please note that Plan N does not cover Medicare Part B excess charges. Excess charges are charges from doctors who do not accept the payment that Medicare gives them as full payment.

Example:

You go to a doctor who charges $100 for his services. The doctor bills Medicare but Medicare comes back and says we only pay $75 for that service. But this doctor wants all of his money and not just what Medicare pays so he has the right to bill you.

Less than 3% of doctors nationwide charge excess charges, and these doctors are usually physiatrists and podiatrists. You will notice that a lot of insurance agents will keep bringing up excess charges to try and scare you into buying more expensive plans which is completely unnecessary.

Guess what…. if you want to know if a doctor or facility accepts Medicare assignment all you have to do is ASK!

How much does Plan N cost?

The costs of Medicare Supplement Plan N vary by location, insurance company, age, and other factors. Typical premiums range from $70 to $150 per month. It’s advisable to shop around with different providers to find the best price and fit for your needs.

Remember that Medigap plans are standardized which means it does not matter which company you are buying from, it will do the exact same thing.

Yearly premium increases

Most people when they buy a Medigap plan look at only how much it costs today but there is another side you have to look at. Every year the premiums for most plans will go up a little just like everything else. Plan N has had some of the smallest increases nationwide year over year.

Who can you enroll in Plan N?

To be eligible for Medicare Supplement Plan N, you must be enrolled in both Medicare Part A and Part B.

When can you enroll in Plan N?

The best time to enroll in Medicare Supplement Plan N is during your Medigap Open Enrollment Period. This 6-month period begins the month you turn 65 and are enrolled in Medicare Part B. During this time, you have a guaranteed right to buy any Medigap policy without health questions.

Example:

Your 65th birthday is June 1, from June 1st to Dec 31st you can enroll in any Medicare Supplement plan without having to answer any medical questions and the plan has to accept you.

If you want to enroll in a Medicare Supplement plan anytime outside of your Medigap Open Enrollment Period you will have to answer medical questions to qualify for enrollment. If you have certain medical conditions the plan can decline your enrollment or issue waiting periods for certain conditions.

Medigap Plans & Advantage Plan (Part C)

If you’re in a Medicare Advantage Plan, it’s illegal for anyone to sell you a Medigap policy unless you’re switching back to Original Medicare. If you aren’t planning to drop your Medicare Advantage Plan, and someone tries to sell you a Medigap policy, report it to your State Insurance Department. If you have Medigap and join a Medicare Advantage Plan, you need to call and cancel your Medigap plan so you don’t get charged. If you drop your Medigap policy to join a Medicare Advantage Plan, you may not be able to get the same policy back.

Conclusion

Medicare Supplement Plan N is an attractive option for those looking for comprehensive coverage at a reasonable price. With its flexibility and considerable coverage, it could be the right fit for many beneficiaries.

However, it’s crucial to weigh the pros and cons, understand your specific needs, and consult with a healthcare or insurance professional. By considering factors such as your budget, health condition, and future healthcare needs, you can make an informed decision about whether Medicare Supplement Plan N is the right choice for you.

Understanding the intricacies of Medicare and Medigap plans can be complex, but with the detailed insights provided here, you’re one step closer to achieving clarity and security in your healthcare coverage.

If you have questions about Medicare, don’t hesitate to contact one of our local agents who work in your community. Visit PascoHernandoSeniorServices.org to schedule an appointment.