Medicare Supplement Plan G is a popular choice among Medicare beneficiaries in Florida, especially in areas like Pasco, Pinellas, Hillsborough, Polk, Hernando, and Citrus counties. This plan offers comprehensive coverage, filling many of the gaps left by Original Medicare (Part A and Part B). Understanding its benefits, costs, and suitability can help you make an informed decision about your healthcare coverage in 2025. This article, “2025 Medicare Supplement Plan G,” will go over everything you need to understand.

I intend to answer most of your questions in this article, but if I miss something please email me at daniel@pascohernandoseniorservices.org and I will answer your question.

What Is Medicare Supplement Plan G?

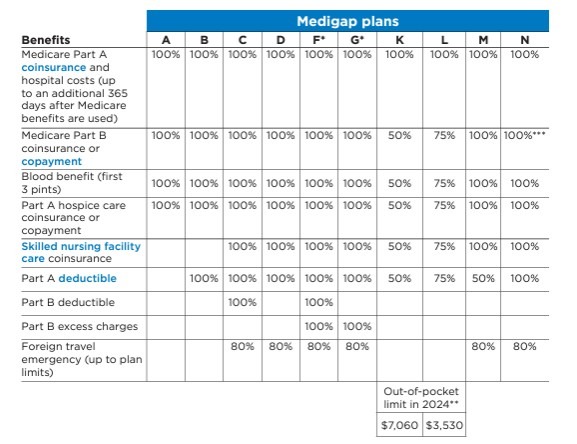

Medicare Supplement Insurance, also known as Medigap, helps cover certain out-of-pocket costs not paid by Original Medicare, such as copayments, coinsurance, and deductibles. Plan G is one of the most comprehensive Medigap plans available to new Medicare beneficiaries, covering all Medicare-approved expenses except the Medicare Part B deductible.

Key Benefits of Plan G:

Hospitalization Costs: Covers Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted.

Medical Expenses: Covers Part B coinsurance or copayment, ensuring you pay little to nothing for doctor visits and outpatient services after meeting the Part B deductible.

Skilled Nursing Facility Care: Covers coinsurance for skilled nursing facility care, providing financial relief during recovery periods.

Excess Charges: Covers Part B excess charges, which are fees that some providers charge beyond the Medicare-approved amount.

Foreign Travel Emergency: Provides coverage for emergency healthcare services during international travel up to plan limits.

2025 Updates and Costs:

As of 2025, there are no significant legislative changes affecting the benefits of Medicare Supplement Plan G. Beneficiaries can expect the same comprehensive coverage as in previous years.

The cost of Plan G varies based on factors such as age, gender, tobacco use, and location. In Florida, monthly premiums for Plan G in 2025 are estimated to range from approximately $170 to $220. For example, in Hillsborough County, premiums with Mutual of Omaha (United World Health) are around $220.63 per month.

High-Deductible Plan G:

For those seeking lower monthly premiums, a high-deductible version of Plan G is available. In 2025, the deductible for this plan is $2,870. After meeting this deductible, the plan offers the same benefits as standard Plan G.

If you are pretty healthy and you don’t use medical services that often but you want protection if something happens, this plan might be right for you. Think of it this way… You get a low monthly premium to be part of this plan and you have to pay all your medical bills until you reach $2,870. Once you have spent that amount, the plan takes over everything else.

If nothing happens in that year, well, you saved a bunch of money on the premium.

Choosing Plan G in Your Area:

When selecting Plan G in Pasco, Pinellas, Hillsborough, Polk, Hernando, and Citrus counties, it’s essential to compare premiums from different insurance providers, as rates can vary. Additionally, consider factors such as customer service, financial stability, and any available discounts.

How to Enroll:

The best time to enroll in Medicare Supplement Plan G is during your Medigap Open Enrollment Period, which begins the first month you’re 65 or older and enrolled in Medicare Part B. During these six months, you have guaranteed issue rights, meaning insurers cannot deny you coverage or charge higher premiums due to health conditions.

If you are outside of your Open Enrollment Period, you can still buy a Medicare Supplement Plan G, but you will have to answer medical questions and be approved by the insurance company. We can help you with that part since we know all the different insurance companies and what the requirements are.

IMPORTANT NOTE:

If you signed up for an Advantage plan when you first became eligible for Medicare, you have a year to decide if you want to keep the Advantage plan or apply for a Supplement plan. It’s like a grace period that you have access to only this one time. If this is you please make sure you contact us as soon as possible.

Annual Review: Review your plan annually to ensure it continues to meet your needs, as coverage, networks, and costs can change every year. To review your coverage,e call 727-777-3608 or CLICK HERE

If you live in Pasco, Hernando, Pinellas, or Hillsborough County, we would love to help you with anything regarding Medicare or Final Expenses. Since 2012, we have been helping others like you in our community be more prepared for the future.

You can give us a call right now at 727-777-3608 to talk to my wife, Shannon. She runs everything in our office, and she will help you with all your questions and scheduling needs.

I intend to answer most of your questions in this article, but if I miss something please email me at daniel@pascohernandoseniorservices.org and I will answer your question.