2024 Medicare Supplement Plan N Overview

Navigating the complexities of Medicare can be daunting, especially for newcomers. With various plans available, each offering different coverage options, it’s crucial to understand the nuances of each plan before making a decision. In this guide, we’ll delve into everything you need to know about one of your options. Medicare Supplement Plan N is a great plan for many people and this “2024 Medicare Supplement Plan N Overview” will give you all the information you need to make a smart decision for yourself or a loved one.

This guide will go over the following subjects:

- What is Plan N?

- What does Plan N help you pay for?

- What’s Not Covered by Plan N?

- When can you apply for Plan N?

It is my intention to answer most of your questions in this article, but if I miss something please email me at daniel@pascohernandoseniorservices.org and I will answer your question.

What is Medicare Supplement Plan N?

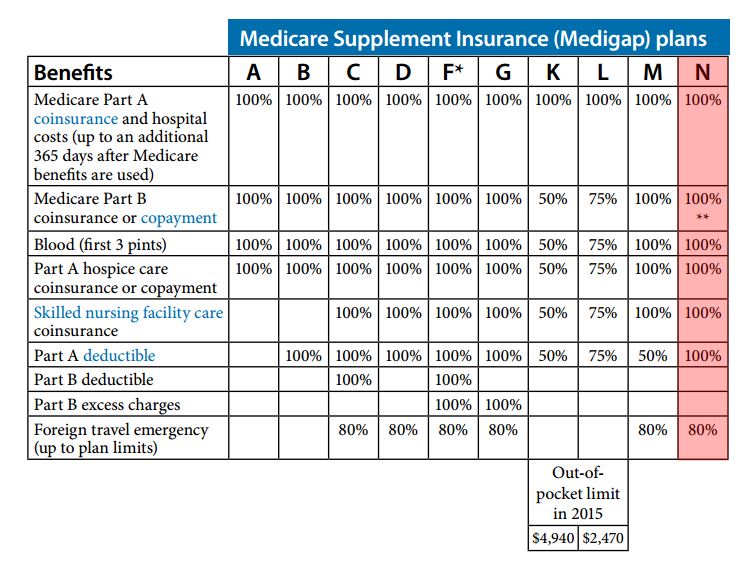

Medicare Supplement Plan N, also known as Medigap Plan N, is one of the standardized Medicare Supplement insurance plans.

You can purchase a Plan N (if you qualify) from private insurance companies like Humana, United Healthcare and many other providers who have contracts with Medicare to offer such plans.

The purpose of Plan N and the other standardized plans is to provides coverage for certain out-of-pocket costs that Original Medicare doesn’t cover, such as copayments, coinsurance, and deductibles.

What does Plan N help you pay for?

- Part A Coinsurance and Hospital Costs: Plan N covers the Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted.

- Part B Coinsurance or Copayment: Plan N pays for the Part B coinsurance or copayment, except for a copayment of up to $20 for some office visits and up to $50 for emergency room visits that don’t result in an inpatient admission.

- Blood Coverage: Plan N covers the first three pints of blood needed for a medical procedure.

- Hospice Care Coinsurance or Copayment: Plan N covers the Medicare Part A hospice care coinsurance or copayment.

What's Not Covered by Plan N?

While Medicare Supplement Plan N provides comprehensive coverage, it doesn’t cover everything. Here are some expenses that Plan N doesn’t cover:

- Medicare Part B Deductible: Plan N doesn’t cover the Medicare Part B deductible.

- Excess Charges: Plan N doesn’t cover Medicare Part B excess charges, which are additional charges that providers may impose beyond what Medicare covers.

- Foreign Travel Emergency: Plan N doesn’t cover foreign travel emergency healthcare expenses.

- Prescription Drugs: Medicare Supplement plans, including Plan N, don’t cover prescription drugs. To get prescription drug coverage, you’ll need to enroll in a standalone Medicare Part D prescription drug plan.

When can you apply for Plan N?

You can apply for Medicare Supplement Plan N during specific enrollment periods. The primary enrollment periods to consider include:

Initial Enrollment Period (IEP): The Initial Enrollment Period for Medicare Supplement plans typically begins when you’re first eligible for Medicare Part B and lasts for six months. During this time, you have guaranteed issue rights, meaning insurance companies cannot deny you coverage based on pre-existing conditions, and they cannot charge you higher premiums due to health status.

Special Enrollment Period (SEP): In certain situations, you may qualify for a Special Enrollment Period, which allows you to enroll in a Medicare Supplement plan outside of your Initial Enrollment Period without facing penalties or restrictions. Qualifying events for an SEP might include losing other health coverage, moving to a new area where your current plan isn’t available, or other specific circumstances outlined by Medicare.

Annual Open Enrollment Period (OEP): Unlike Medicare Advantage plans, Medicare Supplement plans do not have an annual open enrollment period for everyone. However, some states have specific rules that allow beneficiaries to switch or enroll in Medicare Supplement plans during designated periods. It’s essential to check with your state’s regulations regarding open enrollment periods for Medicare Supplement plans.

Guaranteed Issue Rights (GIR): Outside of the initial enrollment period, you may still have guaranteed issue rights in certain situations, such as when your existing coverage is changing or ending (e.g., employer-sponsored coverage or Medicaid), or if you lose coverage due to circumstances beyond your control.

It’s crucial to be aware of these enrollment periods and your rights to ensure you can apply for Medicare Supplement Plan N when it’s most advantageous for your situation. Additionally, working with a licensed insurance agent who specializes in Medicare can provide guidance and assistance throughout the enrollment process.

Why should you review your options?

Health needs and available plan options can change annually.

Healthcare needs might have evolved: Your prescriptions or treatments might have changed over the year, making a different plan more cost-effective.

Plan details change: Insurers can modify provider networks, drug formularies (the list of covered drugs), and plan costs.

New plans become available: Insurers may introduce new plans that better cater to your needs.

Choosing the Right Medicare Supplement Plan for You:

Selecting the right Medicare Supplement plan requires careful consideration of your healthcare needs, budget, and lifestyle. Here are some factors to keep in mind:

- Coverage Needs: Evaluate your healthcare needs and determine which gaps in coverage you want to fill with a Medicare Supplement plan.

- Budget: Consider the monthly premiums, deductibles, and potential out-of-pocket costs associated with each plan.

- Future Health Considerations: Think about any potential changes in your health status and how they might impact your coverage needs in the future.

It is my intention to answer most of your questions in this article, but if I miss something please email me at daniel@pascohernandoseniorservices.org and I will answer your question.