2024 IRMAA: Understanding Medicare's Income-Related Monthly Adjustment Amount

Medicare, the federal health insurance program primarily designed for individuals aged 65 and older, is a crucial aspect of healthcare coverage in the United States. While most Americans become eligible for Medicare at age 65, the program’s costs and benefits are not uniform for everyone. Medicare calculates premium costs based on a variety of factors, and one of the most important elements that affect your Medicare expenses is explained in this article “2024 IRMAA Understanding Medicare’s Income-Related Monthly Adjustment Amount (IRMAA).

In this article, we will explore what Medicare is, delve into the details of IRMAA, and explain how it impacts the amount someone pays for their Medicare premiums.

It is my intention to answer most of your questions in this article, but if I miss something please email me at daniel@pascohernandoseniorservices.org and I will answer your question.

What Is Medicare?

Medicare is a federal health insurance program administered by the Centers for Medicare & Medicaid Services (CMS). It primarily serves three distinct groups of individuals:

People Aged 65 and Older: Most Americans become eligible for Medicare when they turn 65. This group is known as “Original Medicare” beneficiaries and consists of Medicare Part A (hospital insurance) and Medicare Part B (medical insurance).

People with Disabilities: Individuals under the age of 65 who have been receiving Social Security Disability Insurance (SSDI) or Railroad Retirement Board (RRB) disability benefits for at least two years can also qualify for Medicare.

People with End-Stage Renal Disease (ESRD) or Lou Gehrig’s Disease (ALS): Those diagnosed with ESRD or ALS can be eligible for Medicare regardless of their age.

Medicare offers several parts, with each covering specific healthcare services. Medicare Part A covers hospital stays and some skilled nursing facility care, while Medicare Part B covers outpatient services, physician visits, and preventive care.

Understanding IRMAA

IRMAA stands for Income-Related Monthly Adjustment Amount. It is an additional premium that some Medicare beneficiaries must pay on top of their standard Medicare Part B premium. IRMAA is based on an individual’s or couple’s modified adjusted gross income (MAGI), as reported on their tax return from two years ago.

In simple terms, IRMAA assesses a surcharge on your Medicare Part B premium if your income exceeds certain thresholds. This means that high-income individuals or couples pay more for their Medicare Part B coverage.

IRMAA Impact on Medicare Part B Premiums

uring the AEP, you can:

Switch from Original Medicare to a Medicare Advantage Plan (Part C) and vice versa.

Change from one Medicare Advantage Plan to another, if you’re already enrolled in one.

Join a Medicare Prescription Drug Plan (Part D) or change your existing Part D plan. If you’re already in a Part D plan and take no action, you’ll remain in that plan unless it’s discontinued.

Drop Medicare prescription drug coverage altogether.

Why should you review your options?

Now, let’s delve into how IRMAA affects your Medicare Part B premiums. Medicare Part B covers a range of medical services, including doctor visits, outpatient care, and medical supplies. Most people pay a standard premium for Part B, but IRMAA can increase this premium for those with higher incomes.

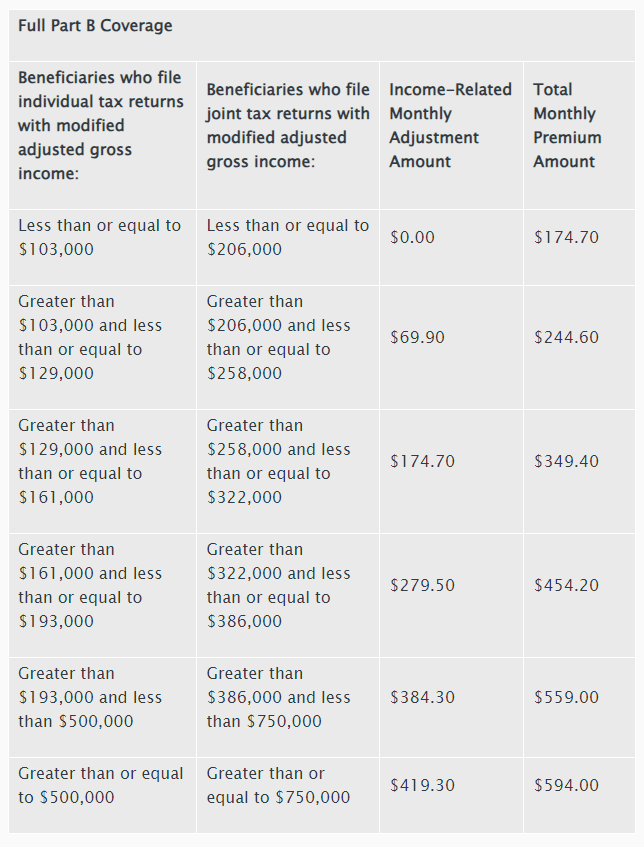

The IRMAA surcharge is determined annually and is based on your MAGI from two years ago. The income thresholds for IRMAA are adjusted for inflation and are different for individuals and married couples filing jointly. Let’s break down the income tiers for 2024:

How much you will pay per month for Medicare Part B

The following income amounts are for individual taxpayers, if you are filing jointly with a spouse double the income limits or see the chart below.

- If your MAGI is below $103,000, you will pay $174.70.

- If your MAGI is between $103,000 and $129,000, you will pay $244.60.

- If your MAGI is between $129,000 and $161,000, you will pay $349.40.

- If your MAGI is between 161.000 and $193.000, you will pay $454.20

- If your MAGI is between $193.000 and $500.000, you will pay $559.00

- If your MAGI exceeds $500,000, you pay $594.00.

If you have questions about Medicare, don’t hesitate to contact one of our local agents who work in your community. Visit PascoHernandoSeniorServices.org to schedule an appointment.

Calculating IRMAA

The calculation of IRMAA can be somewhat complex, as it’s based on a sliding scale that increases as your income rises. To get a better idea of how IRMAA is calculated, consider the following example for an individual:

Suppose John is a Medicare beneficiary, and his MAGI from two years ago (2022) was $120,000. According to the 2024 IRMAA income thresholds, he falls into the second tier, which means he will pay a higher premium than the standard Medicare Part B premium.

The exact IRMAA amount depends on your income tier and whether you’re an individual or part of a married couple filing jointly. For John, his IRMAA amount for 2024 would be added to the standard Part B premium.

It’s essential to review your IRMAA status each year, especially if your income fluctuates. You may have the option to appeal if you believe your income has changed significantly since the two-year-old tax return on which IRMAA is based.

Impact of IRMAA on Medicare Costs

IRMAA can significantly impact the cost of your Medicare Part B coverage. The surcharge can range from a few hundred dollars to several thousand dollars per year, depending on your income and filing status. This additional expense can catch some Medicare beneficiaries off guard, so it’s essential to plan for these potential costs in your retirement budget.

While IRMAA may seem like an additional financial burden, it’s crucial to remember that it helps fund the Medicare program, ensuring its sustainability for future generations. Moreover, the majority of Medicare beneficiaries do not pay IRMAA because their income falls below the thresholds.

Strategies to Manage IRMAA Costs

Tax Planning: Work with a tax professional to explore tax-saving strategies that may reduce your MAGI, such as converting traditional retirement account funds into Roth IRAs.

Timing Distributions: Be mindful of when you take distributions from retirement accounts, as these can impact your MAGI in a given year.

Appeal Process: If your income has decreased significantly compared to the two-year-old tax return used for IRMAA calculations, you may qualify for an appeal and a reduction in your surcharge.

Income-Related Life Changes: Certain life events, such as retirement, divorce, or the death of a spouse, can result in a change in your income status and potentially lower IRMAA costs.

Conclusion

Understanding IRMAA is essential for Medicare beneficiaries who may be subject to income-related surcharges on their Medicare Part B premiums. While it may seem complex, IRMAA is designed to ensure that higher-income individuals contribute more to the Medicare program, helping to support its long-term sustainability.

By staying informed about your income status and exploring strategies to manage IRMAA costs, you can make more informed decisions about your healthcare coverage in retirement. Planning and considering the potential impact of IRMAA on your budget can help you navigate the complexities of Medicare and maintain financial stability throughout your retirement years.

It is my intention to answer most of your questions in this article, but if I miss something please email me at daniel@pascohernandoseniorservices.org and I will answer your question.